Abu Dhabi Machine Learning Season 3 Episode 1

22.09.2022 - Abu Dhabi Machine Learning - ~3 Minutes

When?

- Thursday, September 22, 2022 from 3:00 PM to 5:00 PM (Abu Dhabi Time)

Where?

- ADGM Academy, 20F, Al Maqam Tower, Al Maryah Island, Abu Dhabi

The Meetup page of the event:

Abu Dhabi Machine Learning Meetup Season 3 Episode 1

Programme:

Talk 1: Analyzing FOMC press conferences using video recordings

Abstract: This talk will be about harvesting information in unconventional data such as video images in order to forecast the equity market. I will argue that the behaviour of the President of the Federal Reserve (Fed) captured on camera during important meetings can be used to extract a new generation of signals. Specifically, I propose a new tool to characterize the resolution of uncertainty around the Federal Open Market Committee (FOMC) press conferences. It relies on the construction of a measure capturing the level of discussion complexity between the Fed Chair and reporters during the Q&A sessions. I show that complex discussions are associated with higher equity returns and a drop in realized volatility. The method creates an attention score by quantifying how much the Chair needs to rely on reading internal documents to be able to answer a question. This is accomplished by building a novel dataset of video images of the press conferences and leveraging recent deep learning algorithms from computer vision.

Speaker: Alexis Marchal is a quantitative researcher in one of the largest sovereign wealth fund. He has received a master degree from the university of Geneva and a PhD from the Swiss Federal Institute of Technology in Lausanne and the Swiss Finance Institute. His main research interests are at the intersection of machine learning, asset pricing, and alternative data. Notably, he has worked on applications of Natural Language Processing and Computer Vision to financial markets.

Note that this talk is unrelated to Alexis' current employer and what Alexis is doing at his current job. The presentation covers previous work done during his PhD. This work was presented publicly at several academic and semi-academic conferences in Europe.

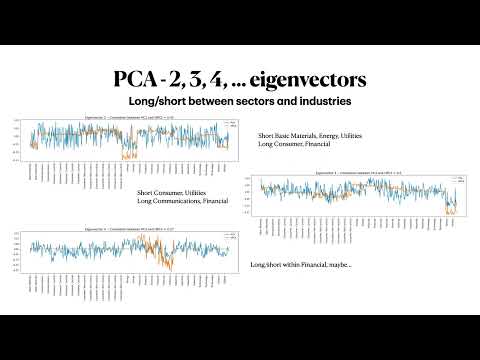

Talk 2: Hierarchical PCA: Incorporate (fundamental) priors into PCA

(a tribute to the late Marco Avellaneda)

Abstract: PCA is a useful tool for quant trading (stat arb) but in its naive implementation suffers from several forms of instabilities which yield to unnecessary turnover (trading cost…) and spurious trades. In order to regularize the model, several techniques are available. We will discuss one in particular: The Hierarchical PCA (HPCA). With HPCA, we modify the empirical correlation matrix such that it incorporates information from a prior (fundamental) hierarchical classification: For example, sectors and industries for stocks and bonds; protocols, layers and use cases for cryptos. We will illustrate this presentation with some basic python code and results comparing PCA and HPCA for stocks and cryptos.

Speaker: Gautier Marti is a quantitative trader with experience in credit default swaps, corporate bonds, equities and crypto futures markets. Gautier Marti worked for several asset managers and hedge funds in Abu Dhabi, Hong Kong, London, and Paris (reverse chronological order).

His research interests include (excluding proprietary research for alpha strategies) generative adversarial networks, knowledge graphs, graph neural networks, information geometry, geometry of correlation matrices, hierarchical clustering.

Note that this talk is unrelated to Gautier’s current employer and what Gautier is doing at his current job. The presentation covers material published by Marco Avellaneda in the paper Hierarchical PCA and Applications to Portfolio Management https://arxiv.org/abs/1910.02310.

Video Recording of the ADML Meetup on YouTube

- YouTube videos:

ADML S3E1 - Hierarchical PCA: Incorporate (fundamental) priors into PCA