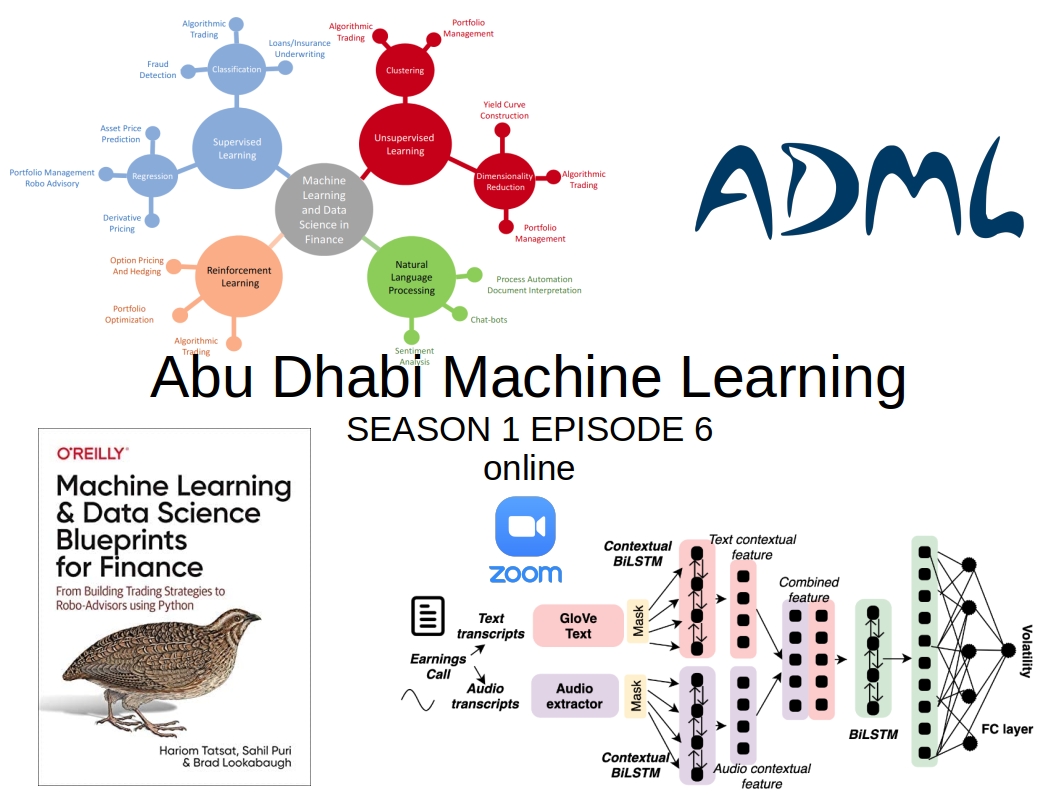

Abu Dhabi Machine Learning Season 1 Episode 6

06.07.2021 - Abu Dhabi Machine Learning - ~3 Minutes

When?

- Tuesday, July 6, 2021 from 7:00 PM to 9:00 PM (Abu Dhabi Time)

Where?

- At your home, on zoom. All meetups will be online as long as this COVID-19 crisis is not over.

Programme:

Talk 1: Blueprints for Machine Learning and Data Science in Finance

Abstract: Over the next few decades, machine learning and data science will transform the finance industry. According to several studies, many new roles in AI and Machine Learning will come up and conventional finance jobs might slowly fade away. So, machine learning professionals, quants and machine learning professional need to reinvent themselves to align with the requirements of the market. In this talk, Hariom will talk about the machine learning techniques and toolkit customized to finance from his book “Blueprints for Machine Learning and data science in Finance” and how it can enable the industry professionals to reinvent themselves. He will talk about the current and future landscape of Machine Learning and data science in Finance, how ML and AI is used across different areas of finance and how it can complement the traditional finance. He will demonstrate the standardized machine learning templates that can be easily cloned and applied to any machine learning problem statement. He will then go through few case studies in Fraud detection and derivative pricing using standardized python-based template. Overall, the talk, although not very technical, is targeted to enable practitioners to keep their skills up to date and promote democratization of Machine Learning and data science in finance.

Bio: Hariom Tatsat currently works as a Vice President in the Quantitative Analytics division of an investment bank in New York. Hariom has extensive experience as a Quant in the areas of predictive modelling, financial instrument pricing, and risk management in several global investment banks and financial organizations. He completed his MS at UC Berkeley, his BE at IIT Kharagpur (India).

Material:

- Blueprints for Machine Learning and data science in Finance

- GitHub repo with code associated to the book

- Slides of the talk

Hariom Tatsat is open to research and project collaborations. Please, feel free to reach out to him.

Talk 2: An Empirical Investigation of Bias in the Multimodal Analysis of Financial Earnings Calls

Ramit Sawhney will present his paper “An Empirical Investigation of Bias in the Multimodal Analysis of Financial Earnings Calls” where he and his co-authors analyze speech signals of company executives.

Volatility prediction is complex due to the stock market’s stochastic nature. Existing re-search focuses on the textual elements of financial disclosures like earnings calls transcripts to forecast stock volatility and risk, but ignores the rich acoustic features in the company executives speech. Recently, new multimodal approaches that leverage the verbal and vocal cues of speakers in financial disclosures significantly outperform previous state-of-the-art approaches demonstrating the benefits of multimodality and speech. However, the financial realm is still plagued with a severe under-representation of various communities spanning diverse demographics, gender, and native speech. While multimodal models are better risk forecasters, it is imperative to also investigate the potential bias that these models may learn from the speech signals of company executives. In this work, we present the first study to discover the gender bias in multimodal volatility prediction due to gender-sensitive audio features and fewer female executives in earnings calls of one of the world’s biggest stock indexes, the S&P 500 index. We quantitatively analyze bias as error disparity and investigate the sources of this bias. Our results suggest that multimodal neural financial models accentuate gender-based stereotypes.

Material:

- paper

- GitHub repo

- Slides of the talk

- Earnings calls dataset available on GitHub and direct link for download

- librosa Python package for music and audio analysis (to extract features)

- Parselmouth a Python wrapper on top of Praat, a computer program to analyse, synthesize, and manipulate speech